Comprehensive Information of 30-Year Fixed Mortgage Calculator

Jan 16, 2024 By Susan Kelly

A mortgage calculator is a perfect tool that translates loan amount and house cost into an approximate monthly payment (Installments). A Simple mortgage calculator may be a useful tool that calculates some problematic figures and estimates the monthly income, but some calculators may not provide a perfect view of expenditures.

A 30-year Fixed Mortgage calculator means the payment schedule is done for 30 years, and the monthly interest rate is fixed for the duration of the loan. When a user takes a fixed loan for 30 years, the monthly income remains the same as long as they pay off the loan.

This tool comes with numerous loan terms, amounts, and interest rates. It has the latest features, such as calculating property taxes, amortization tables, homeowners insurance, property mortgages, and calculated loans. To know more, keep reading!

Fixed Mortgage Calculator - Everything You Must Know About It

If you are interested in knowing about the 30-Year Fixed Mortgage calculator, then you are in the right place. Hit the article to get a complete guide.

Using the 30-year Mortgage Calculator

The mortgage calculator has some key factors that suit the monthly cost of a mortgage, including interest rate, house price, and down payment cost. There are many banks that provide a variety of home loans with different terms and conditions.

To use this tool, you can input the value in every field, like fields of loan term, down payment, home price, and interest rate. In the field of down payment, a user can populate the cost and percentage; the calculator will fill other fields automatically. Lots of people may use a free Mortgage calculator to save their assets.

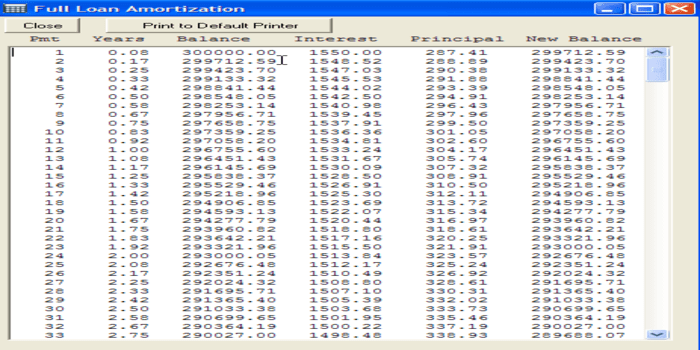

This tool allows you to attain a detailed estimated price for any homeowner by adding insurance. You should pay for the home; these costs that you may view by clicking on the field of "additional options" may be added. While some costs may not be created while making a mortgage payment, they are certainly a part of the monthly budget. By clicking on "calculate," users may view the breakdown of monthly payments with a schedule of amortization. This is how you will pay your interest every month.

Costs and Requirements

At the end of 2022, the percentage of average interest rate for 30 years was 5% with the fixed rate mortgage. Closing cost is also compulsory that is associated with a mortgage, generally starting from 2% and ending on a 5% loan, so this may be added. A user may require a good credit score to receive the perfect interest rate. However, for lots of people, the most difficult aspect of securing their mortgage is the paperwork. People may be required to show the ability to create mortgage costs and cash on schedule.

People may also give them a bank statement for savings and checking accounts, other brokerage, and retirement for the last 60 days. There are some other things that may give them, such as loans, credit card balances, and liabilities. The bank may also look for rent checks(if any) or a letter from the guardian or landlord(just to get proof) that people pay their house rent in a timely.

Comparison of 30-year Mortgages with Other Loan Terms

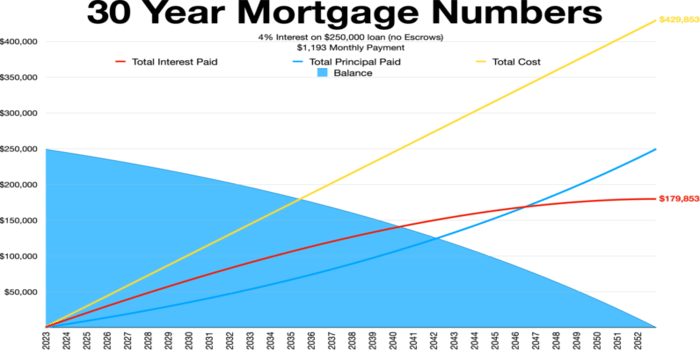

This tool tends to be away for just one reason: that is the longest term applicable from some lenders. That converts to the lowest, inexpensive monthly cost and a choice of many consumers. Nonetheless, this opportunity of affordability has some costs. Over the period of a 30-year loan, people will pay crucially more in interest than they would with a 15-year mortgage.

If they want to create equity faster or may afford a higher monthly mortgage cost, they might look into a loan with a shorter duration than 30 years. There is one exception: in some cases, mortgage payments may be deducted from taxes. For certain individuals, this may help to reduce higher mortgage costs.

How to Find the Best 30-year Mortgage

To get started, approach a lender with whom you presently have an interaction, such as another loan or bank account. However, people should always see different lenders to discover the perfect rate and conditions for their needs.

To locate the best loan, people may first need to improve their credit score, use the calculator, and gather documents to get an idea of how much they may pay. However, a simple Mortgage calculator also has good features.

Mortgage Calculator Results

To take advantage of the mortgage calculator, provide some loan details that are listed below:

Home price

It is the purchase cost of the house.

Down payment

The cash that people pay in advance to purchase a property is represented as a percentage of the total loan cost. The quantity of the down payment might attract and influence the interest rate; lenders often provide lower rates for greater down costs. The total cost of Mortgage over 30-Years fluctuates according to the policy of bank rates.

Loan term

The time you get to pay back a loan is called the loan duration. Usually, if you have more time to pay, your monthly payment is smaller, but you end up paying more interest overall. On the other hand, if you have less time to pay, your monthly costs are higher, but the interest rate is lower.

Loan APR

The expenses associated with borrowing are according to a percentage of the debt. On the other hand, input the range of credit scores to obtain a monthly payment estimation. (Default Setting = Last Month's National Average.)

Property taxes

The yearly tax that people pay as an authentic owner of the property is imposed by the city, Municipality, or country. (Default Setting=The National Average).

Conclusion

Mortgage Calculator is the latest way to calculate huge amounts like property loans. If you are also interested in Mortgage Calculator, then follow the above article to get more information. This article is about a 30-year Fixed Mortgage calculator. Surely, this calculator is worth using.

Good luck, folks!